Methodology

The Central Bank’s data collection for the purpose of statistical processing is governed by Article 32 of the Act on the Central Bank of Iceland, no. 92/2019. Statistics lay the foundations for the Bank’s assessment of important aspects of monetary policy and financial stability. In accordance with Article 41 of the Act, Statistics Iceland also has access to the data compiled by the Central Bank, based on a cooperation agreement between the institutions.

Standards

The statistics are processed in accordance with international standards on statistical reporting, including those issued by the World Bank, International Monetary Fund (IMF), Bank for International Settlements (BIS), Organisation for Economic Co-operation and Development (OECD), European Central Bank (ECB), Eurostat (the EU statistical bureau), and the United Nations (UN). The purpose of the standards is to ensure international comparability of statistics, both overall and with respect to data quality. International standards define methodologies, concepts and terminology, and presentation of statistics, and they provide guidance on professional work habits, impartiality, and confidentiality in connection with processing.

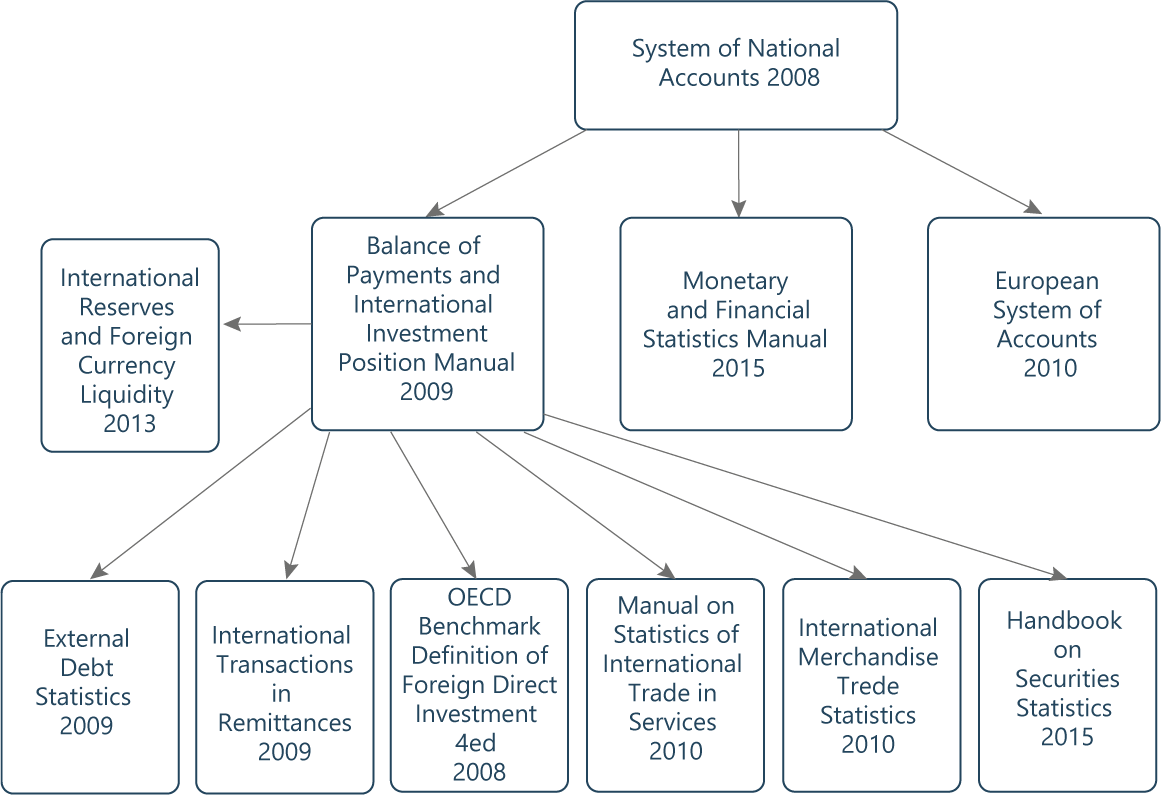

The national accounts standards issued by the above institutions in 2009, called the System of National Accounts 2008 (SNA 2008), are used as a basis for the other standards. The chart below illustrates the relationship between the standards. International institutions place emphasis on harmonising the terminology and classification systems used in international standards so as to enhance the comparability of statistics. As a result, the standards are all related and, for the most part, are consistent with the SNA 2008 standards.

Preparation of Central Bank statistics is based primarily on the standards for national accounts, balance of payments and international investment position, and monetary and financial statistics. Balance of payments statistics are based also on standards providing detailed information on specific topics, such as foreign direct investment, securities, or foreign exchange reserves.

According to the national accounts standards, the economy is divided up into five overall sectors, plus the foreign sector, as the table below shows. Firms, institutions, and non-profit institutions are then classified together in a sector within the economy, based on their activities.

| Category | Sector |

|---|---|

| S.11 | Non-financial corporations: Institutional units that produce goods and non-financial services for sale in the market. |

| S.12 | Financial corporations: Institutional units that produce financial services and act as financial intermediaries. Divided into nine sub-sectors. |

| S.13 | General government: state and local authorities. |

| S.14 | Households: One or more individuals who share the same living accommodation and consume certain types of goods and services collectively, namely housing and food. |

| S.15 | Non-profit institutions serving households (NPISH): Institutional units that produce goods and services for households, either for free of charge or at a low price. |

| S.2 | Rest of the world: Institutional units residing outside Iceland. |

Show all

Balance of payments

Financial institutions

Quality issues

The quality of statistics depends on the data that can be collected on the topic concerned and the methods used to process them. It is of key importance that the regulatory framework support the institutions that prepare statistics, guarantee them professional and financial independence, and provide sufficient statutory authority for data compilation. The Central Bank places emphasis on following sound, recognised methodology in compiling data and preparing statistics. It stresses that the statistics must be reliable, impartial, and objective; that data processing be carried out according to defined procedures; and that the quality of the data be verified to the extent possible. Furthermore, the publication of statistics must be clear and user-friendly, the data must be easily accessible, and metadata must be available for all statistics.

Quality assessments of statistics are conducted by the IMF and Eurostat. The IMF’s 2005 assessment, entitled Report on the Observance of Standards and Codes, can be found here.